The main activity of SEC Aqjaiyq JSC is to promote the economic development of the West Kazakhstan region by consolidating the efforts of the public and private sectors

News and announcements

Our projects

Investor Assistance

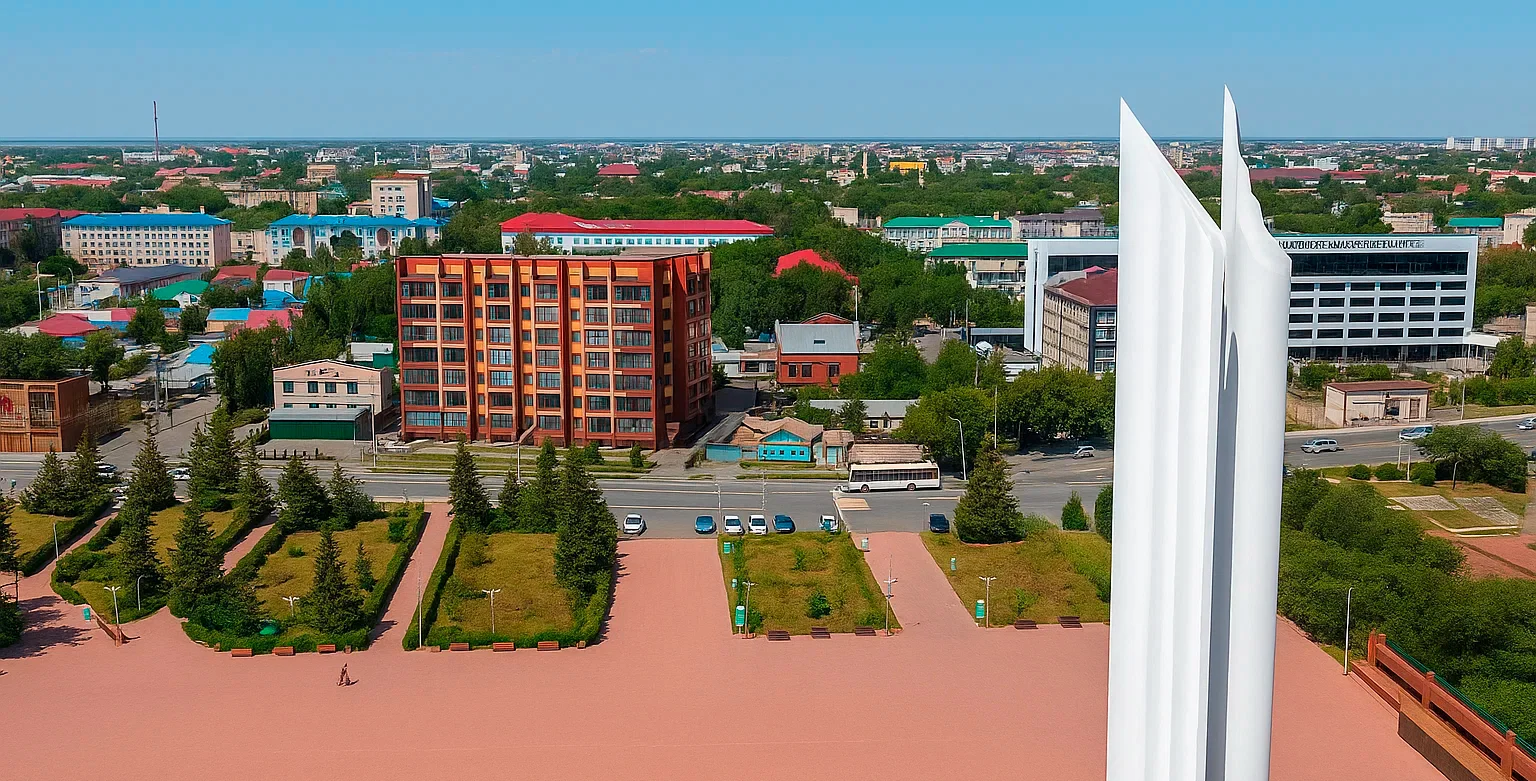

Unique and unrepeatable appearance of Uralsk and, above all, its historical landmarks of the XVIII - XIX centuries: Pugachev's cottage, the Old cathedral, the Church of Christ the Savior, the house of the governor, the house of Karëva, the building of the regional administration, the city park of culture and recreation. Modernity makes new residential areas and high-rise buildings, buildings of airports and railway stations, monuments to Abay, S. Dato, M. Mametova, V. I. Chapayev, A.S. Pushkin, and the Victory Memorial with a eternal flame of glory and others.